UNICAP – Collateralized Swap Token.

Introduction CETF

A crypto exchange-traded fund (CETF) is a type of fund and exchange-traded product, i.e. they are traded on crypto exchanges. CETF are similar in many ways to mutual funds, except that CETF are bought and sold throughout the 24 hours on crypto exchanges. An CETF holds assets such as cryptocurrency, tokens, coins, and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally occur.

A CETF divides ownership of itself into tokens that are held by token holders. The token holders indirectly own the assets of the fund. Token Holders are entitled to a share of the profits, and they would be entitled to any residual value if the fund undergoes liquidation.

CETF may be attractive as investments because of their low costs, asset aggregation, and tradability. Source: https://en.wikipedia.org/wiki/Exchange-traded_fund

Сollateralized

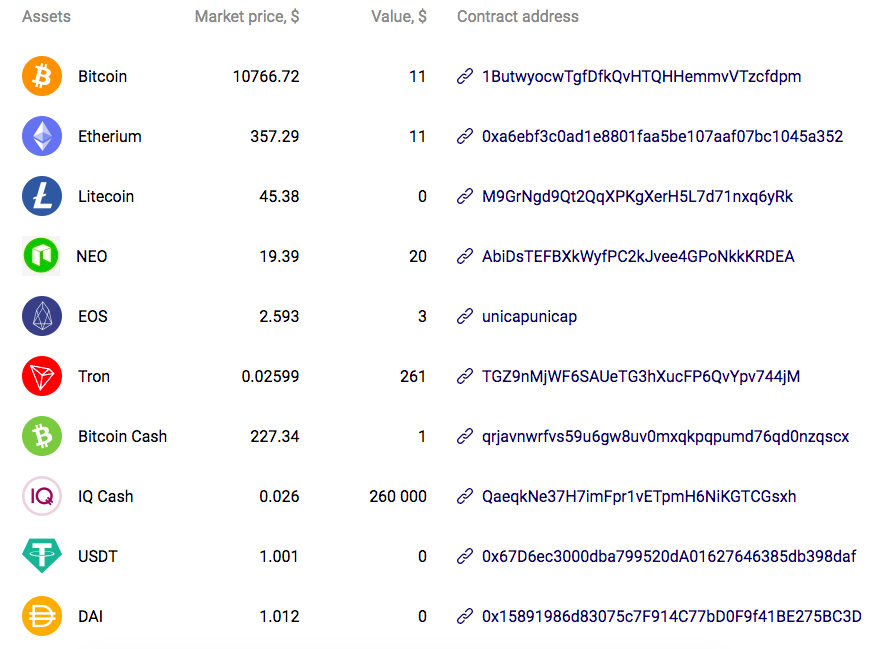

You do not buy a token but collectively invest into the fund swapping your funds to UCAP tokens. Your funds are allocated at the fund accounts and all the transactions are transparent. That is why every token UCAP will be initially 90% сollateralized with real cryptocurrency and liquidity tokens which the swap is done for.

Reliability

The project was created by the company FINEXPO existing since 2002. FINEXPO major projects are exhibitions and luxury trade shows organized annually all around the world. These events were attended by more than 200,000 visitors and 3,000 worldwide companies. The company is also the owner of IQ.cash and Master.Money. The geography of these shows is really broad and covers the following countries: Thailand, Malaysia, Indonesia, Singapore, Vietnam, India, Egypt, Cyprus, China, Philippines, Kazakhstan, Russia, Ukraine, Slovakia, Latvia, etc.

Transparency

CETF transparent. CETFs are priced continuously throughout the 24-hour-trading and therefore have price transparency.

Trading

CETF can be bought and sold at current market prices at any time during the 24 hours. Also, investors can execute the same types of trades that they can with a cryptocurrency, such as limit orders, which allow investors to specify the price points at which they are willing to trade, stop-loss orders, margin buying, hedging strategies, and there is no minimum investment requirement. Because CETF can be cheaply acquired, held, and disposed of, some investors buy and hold CETF for asset allocation purposes, while other investors trade CETF shares frequently to hedge risk or implement market timing investment strategies.

Market exposure and diversification

CETF can provide some level of diversification. CETF provides an economical way to rebalance portfolio allocations and to invest cash quickly.

The Problem

Most of the coin and token owners (investors) face:

● Absence of additional passive income.

● Inability of profile creation from several tokens/coins and its professional management.

● Time and resource loss in the process of day trading. Learning and adjusting to artificial intelligence systems.

● Commission losses.

● Constantly following the new tendencies and deciding whether to buy perspective tokens and coins or not.

In a search for profit they start to pay attention to fast-developing DeFI start-ups. However, here they notice that most of DeFi tokens don’t have the actual business but only expectations of how successful the project will be, so they can easily increase and likely easily fall in their price.

Market difference can reach 1-100-1 USD, so only founders get income from it. All projects don’t forward the actual profit to investors, so many of them get into the scam category. We have analyzed the market and created a secure, profitable and transparent project UNICAP.

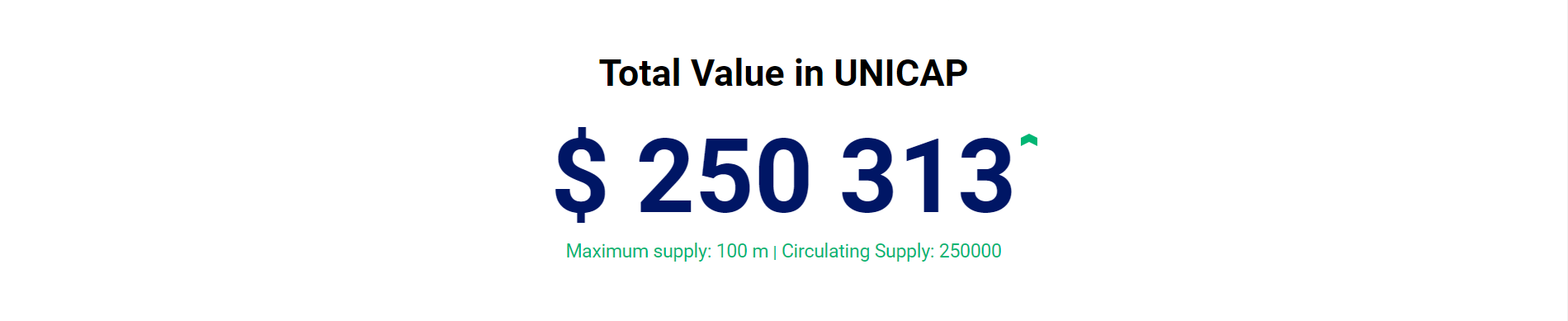

Finance Fund with DeFi ecosystem for getting additional profit from your inactive crypto assets. Investors can solve these problems, start increasing the profit and getting stable income only by creating a crypto fund (collective investment). We have created secured exchange token UCAP which you are provided with instead of the investment as a part of a fund UNICAP.

You do not buy a token but collectively invest into the fund swapping your funds to UCAP tokens. Your funds are allocated at the fund accounts and all the transactions are transparent. That is why every token UCAP will be initially 90% сollateralized with real cryptocurrency and liquidity tokens which the swap is done for. 10% will be reserved by the company management for control, development, listings at the leading exchanges and project advertisement. The profit of the DeFi ecosystem operation will be forwarded to the fund additionally which is going to increase token cost and cover the initial expenses on fund management as well as market fund cost increase.

Token swap to your funds is planned as multi-leveled (min 90 levels). The price will increase on $0.1 every next level (300,000 – 1,000,000 tokens)! After Pre Public Swap Levels and listing, tokens will swap/sale at the price set by the exchange, but no less than the current level. The starting price $1 will increase up to more $20 by the end of allocation of all tokens which will bring quite a profit to the first fund investors.

The opportunity to swap UCAP tokens to the fund “Buy Back” will be available on further levels (after listing) or you can use the token as a financial instrument of a part of all funds for pools or exchange trading. Swap “Buy Back” UCAP – all tokens to be returned to the fund will be frozen and swap/sale to cryptocurrency in the future after level 90! Swap “Buy Back” 5% OFF commission to fund. Min “Buy Back” swap 10,000 USDT. Swap Price UCAP = Net Worth / Token Circulation

Tokens will be listed on the leading exchanges (Bittrex, OKEX, Huobi, Binance, FTX, BitHumb, UpBit, BitFinex and more) after Pre Public Swap period. Liquidity pools will be created at all leading DeFi platforms.

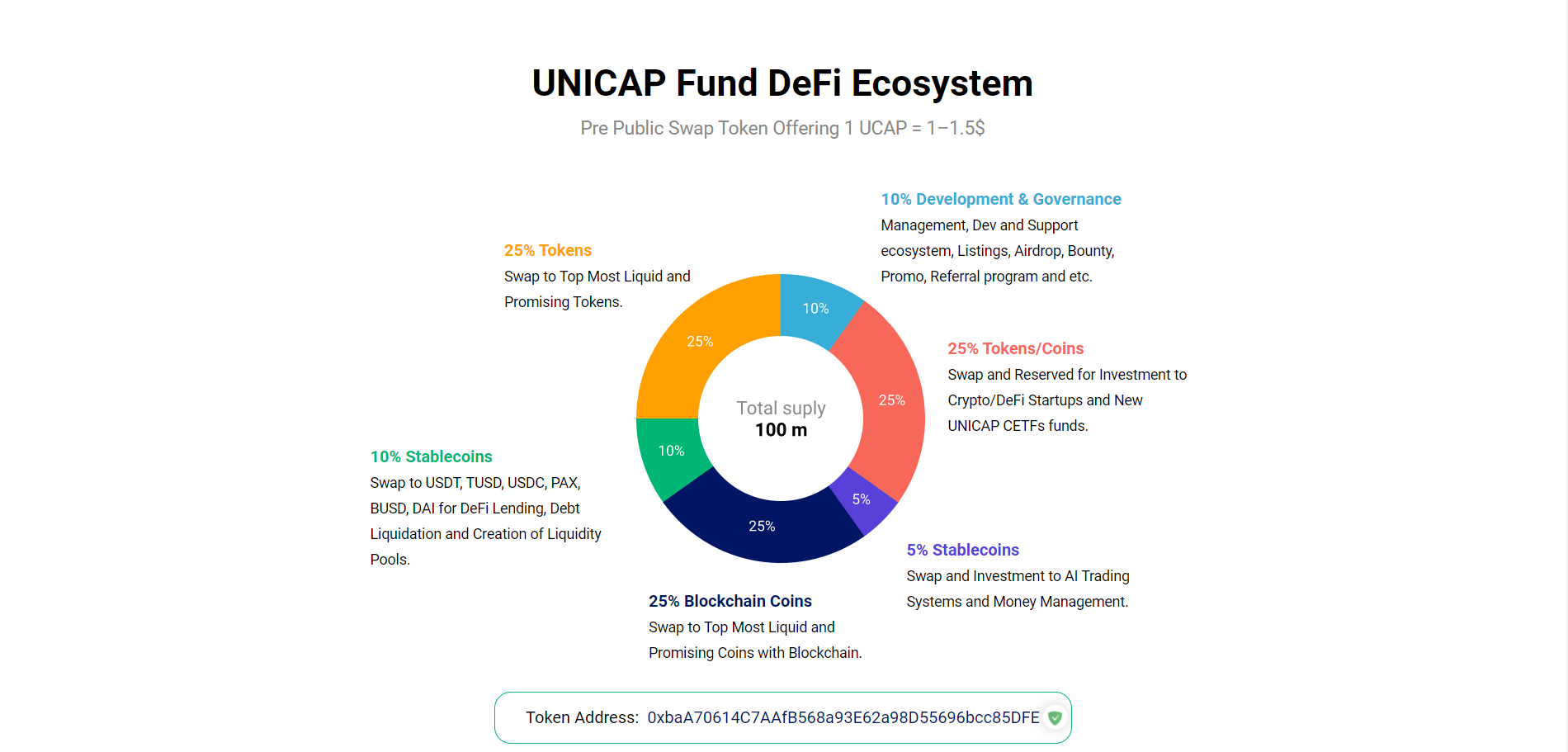

UCAP Supply Allocation 10% / 90%

● 10%: Development & Governance

● 90%: UNICAP project

UNICAP fund Supply Allocation:

● 5% Stablecoins.

Investment AI Trading Systems and Money Management USDT, TUSD, USDC, PAX, BUSD, DAI. Allocation of funds in a form of stable coin for artificial intelligence system trading. Short-term trading – day trading. Futures, options and synthetic instruments trading.

● 25% Reserved for Investment to Crypto/DeFi Startups and new UNICAP CETFs funds.

Promising startup token/coin swap to UCAP token for project development, partnership listing and capitalization multiplication for further profit and fund capitalization increase. It is planned that UCAP token owners will vote for investing in startups.

● 10% Stablecoins.

USDT, TUSD, USDC, PAX, BUSD, DAI for DeFi lending, debt liquidation and creation of liquidity pools.

● 25% Blockchain Coins.

Top most liquid and promising coins with blockchain. Profile management. Fund rotation for liquidity and capitalization increase by swapping inactive or decreasing to more promising in terms of fund policy.

● 25% Tokens (Any Platform).

Top most liquid and promising tokens. Profile management. Fund rotation for liquidity and capitalization increase by swapping inactive or decreasing to more promising in terms of fund policy.

UNICAP Ecosystem

Token Specifications and Sale Allocation

● Token Ticker: UCAP

● Token Type: ERC-20

● Blockchain: Ethereum

● Legal Classification: Utility Token

● Total Supply (No. of Tokens): 100,000,000

Private Swap: 250,000 UCAP (0.20%) at USD 0.8 per UCAP

● Pre Public Swap Level 1: 300,000 UCAP (0.30%) at USD 0.8 – 1 per UCAP

● Pre Public Swap Level 2: 500,000 UCAP (0.50%) at USD 0.9 – 1.1 per UCAP

● Pre Public Swap Level 3: 500,000 UCAP (0.50%) at USD 1 – 1.2 per UCAP

● Sale Level 4: 500,000 UCAP (1%) at USD 1.1 – 1.3 per UCAP

● Sale Level 5: 500,000 UCAP (1%) at USD 1.2 – 1.4 per UCAP

● Sale Level 6: 1,000,000 UCAP (1%) at USD 1.3 – 1.5 per UCAP

● Sale Level 7-100: 1,000,000 UCAP (1%) each level at USD 1.4 – 20 per UCAP

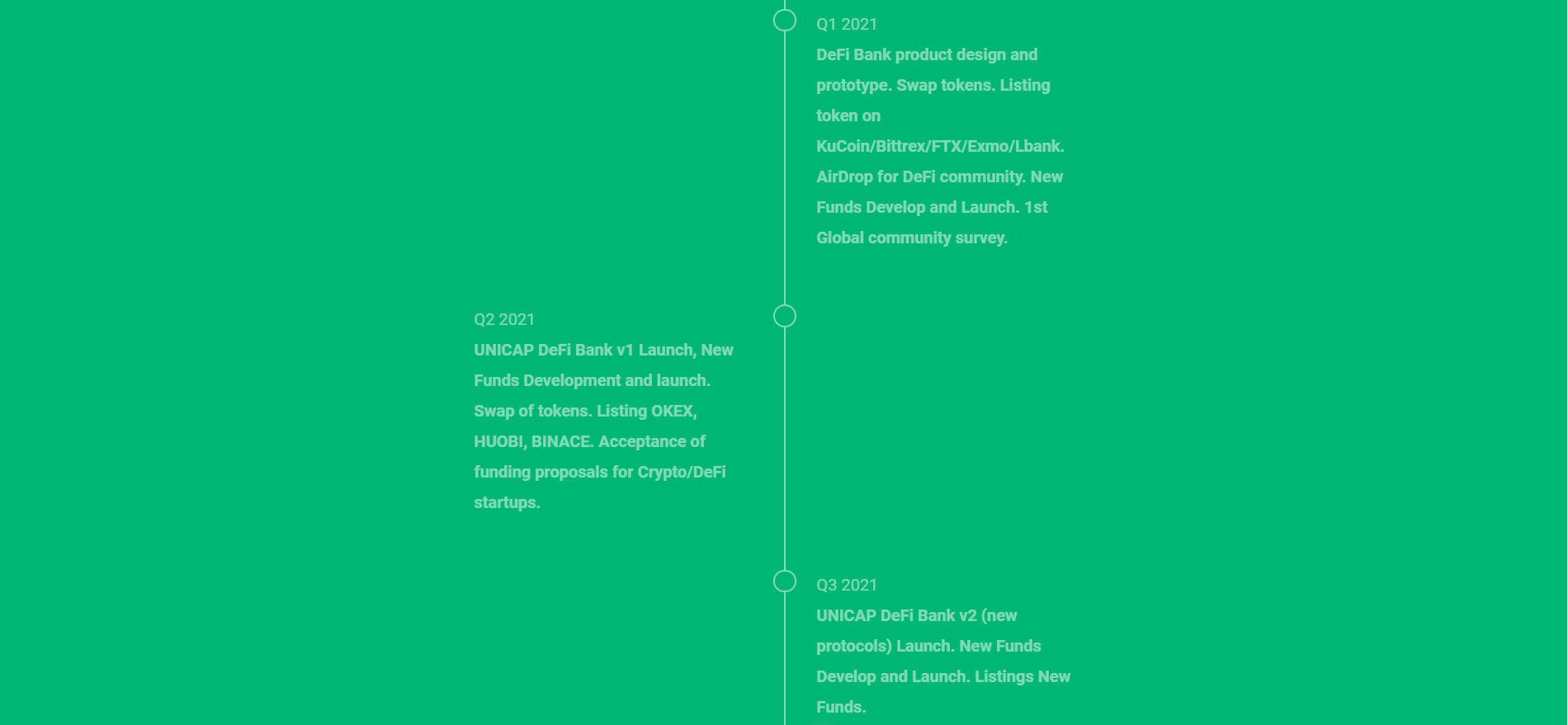

Roadmap

#ETF #Ethereum #bitcoin #eth #uniswap #defi #gem #investing #altcoins #exchange #money #cryptocurrency #trading #investment #decentralized.

To get clearer information, please visit the link below:

● Website: https://ucap.finance/

● UNICAP_WP: https://ucap.finance/docs/ucap_wp_v1.pdf

● Telegram: https://t.me/unicap_finance

● Facebook: https://facebook.com/tradersfair

● Twitter: https://twitter.com/unicapfinance

● Linkedin: https://www.linkedin.com/showcase/unicapfinance/

● Discord: https://discord.gg/BJBA4Yb

● ANN: https://bitcointalk.org/index.php?topic=5278941.msg55283491

AUTHOR

Bitcointalk Username: jamaah45

Telegram Username: @jamaah

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=2502762

Wallet address (eth): 0x7A5df2D8D32b8f8e4FC6BF71D2BDfe69992D1C1B

Komentar

Posting Komentar